Facts and Solutions on Down Payments

When you think about purchasing a home, the biggest obstacle many people face is coming up with a down payment to purchase a home. In fact, 2022 saw a decrease in the number of first time home buyers because of home prices, down payments and interest rates. For first-time home buyers, 26 percent said saving for a down payment was the most difficult step in the process. It does not help that these buyers do not understand all the facts and the resources available to them. But don't let common misconceptions about down payments make the process harder than it could be.

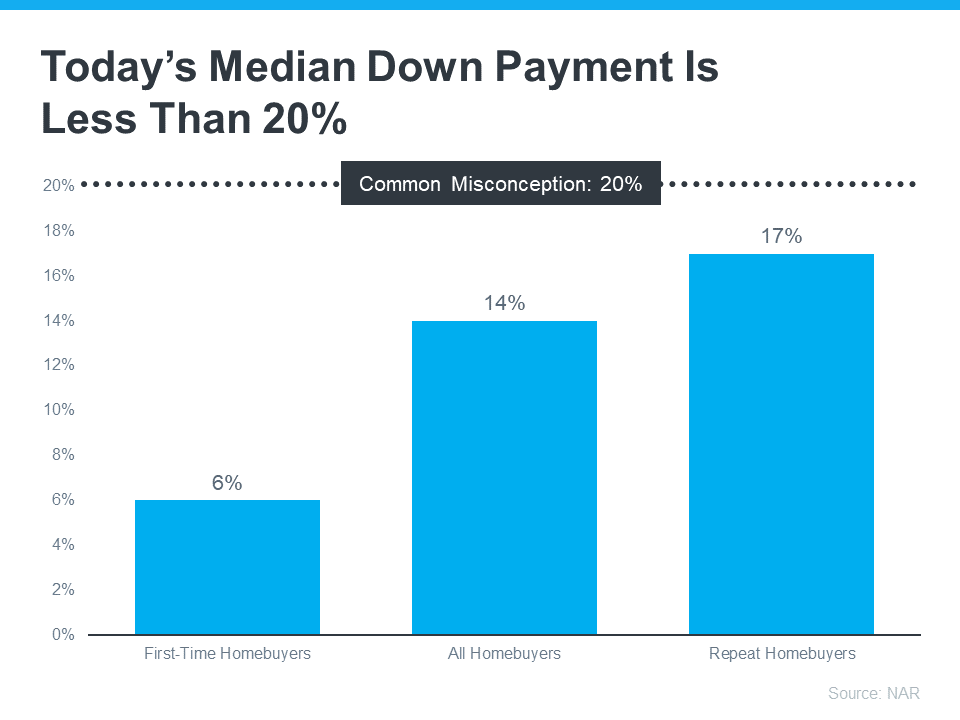

Myth 1: You need to put down 20% of the home's purchase price as a down payment

20% Isn’t Always the Typical Down Payment. While this is a common guideline, it is not a hard-and-fast rule. In fact, the median down payment for first time buyers is 6% and 17% for repeat buyers. Many lenders, including will offer mortgage products with down payment requirements as low as 3% or 5%. While many banks offer this through FHA loans, GRA is currently offering a conventional loan with 3% down. Finally, veterans and their families can even get loans that have a $0 down payment.

Be aware that you will need to pay mortgage insurance if your down payment is that low but the rates for this have become much more reasonable.

Myth 2: You can't use gifted funds for your down payment

Some lenders will allow you to use gifted funds for your down payment, as long as the gift is documented and meets certain requirements. 22 percent of first-time

buyers used a gift or loan from friends or family for their down payment.

Myth 3: You can't use retirement funds for your down payment

You can't use your retirement savings for a down payment: Depending on the type of retirement account you have, you may be able to use your savings for a down payment without incurring any penalties. However, it's important to weigh the long-term consequences of using your retirement savings before making this decision.

Myth 4: You have to have perfect credit to get a mortgage

While having good credit can make it easier to qualify for a mortgage and get a better interest rate, it is not a requirement to get a home loan. In fact, it is sometimes easier to get a mortgage than to get a rental. There are mortgage products available for borrowers with less-than-perfect credit. If you need or want to take steps to improve your credit, speak to your lender about steps that you can take.

If saving for a down payment still feels like a challenge, know that there’s help available. A real estate professional and trusted lender can show you options that could help you get closer to your down payment goal. According to latest Homeownership Program Index from Down Payment Resource, there are over 2,000 homebuyer assistance programs in the U.S., and the majority are intended to help with down payments.

To understand your options, be sure to do your homework. If you’re interested in learning more about down payment assistance programs, information is available through sites like Down Payment Resource. Then, partner with a trusted lender to learn what you qualify for on your homebuying journey.

Bottom Line

If you want to purchase a home this year, let’s connect. You’ll also want to make sure you have a trusted lender so you can explore your down payment options.